News and Updates

When life happens, make sure you and your family are covered

When changes occur in your life, it’s important to review your benefits coverage and ensure that appropriate coverage is in place for you and/or your eligible dependants.

![]() For most eligible life events, you have 31 days after the life event to make changes to your coverage. After 31 days, you may need to provide proof of good health (evidence of insurability) and you could be denied coverage and/or be subject to limited coverage for the first 12 months.

For most eligible life events, you have 31 days after the life event to make changes to your coverage. After 31 days, you may need to provide proof of good health (evidence of insurability) and you could be denied coverage and/or be subject to limited coverage for the first 12 months.

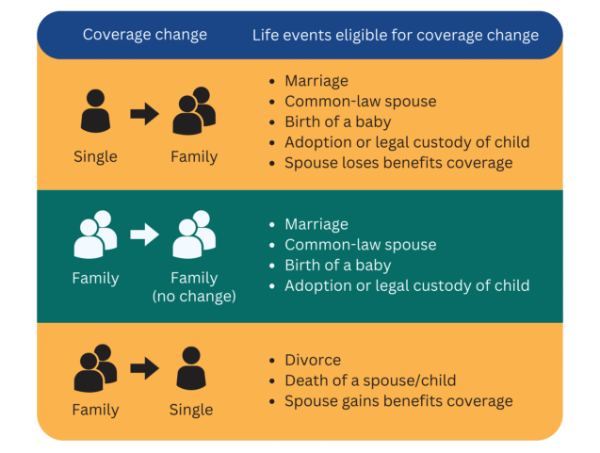

If your family status has changed due to a life event such as marriage or the birth of a baby, you are eligible to change your benefits coverage. The chart below outlines examples of some corresponding coverage changes that can be made as a result of your eligible life event.

Note: To be considered common-law spouses, two people must have cohabitated for at least 12 months. The common-law spouse must be added to the plan within 31 days of having satisfied the 12-month qualification period.

Coverage for over-age student and disabled dependants

Your child is eligible for coverage under your benefits plan if under age 21 OR as an over-age student if they are a full-time student at an accredited institution and under the maximum age listed in your benefits booklet. If you have an over-age student covered under your plan, OTIP will send you a notice each year to confirm your dependant’s eligibility to maintain their coverage under your plan.

A dependant who is incapacitated or disabled on the date they reach the maximum age when coverage would normally end may continue to be eligible for coverage if the child was covered under the benefits plan before that date. The application for over-age disabled dependant coverage must be completed within 31 days of the dependant reaching the maximum age when coverage would normally end.

Additional resources:

-

Read about coverage change deadlines, FTE status changes, leave coverage, and more.

-

Learn how to make changes to your coverage.

-

Find out how to set up coordination of benefits if you have more than one family benefits plan.