News and Updates

Will I pay less for insurance if I have a car with new safety technology?

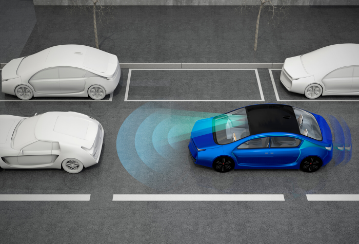

Advanced auto safety technology, once reserved for top-of-the line luxury vehicles, is becoming increasingly common in new cars. As safety engineering continues to advance, vehicle protection features such as autobraking systems, blind spot detection warnings, rear-view cameras and more are beginning to find their way into the mainstream.

As vehicle safety remains a top concern for new-car buyers, the increasing popularity of car safety technology has many drivers wondering how it will impact their insurance.

Drivers are often under the assumption that modern safety features lower insurance premiums by reducing the likelihood of a collision. While new car safety technologies can help drivers avoid some of the most common accidents, they cannot guarantee that your car will be safe from all potential road hazards. In fact, when collisions do happen, vehicles equipped with a suite of advanced safety features can be more complicated and expensive to repair. Your insurance provider factors repair costs into your auto policy premiums.

Benefits of owning a vehicle with new safety technology features

Opting for increased vehicle safety features doesn’t go unrewarded by insurance providers. All of the safety specifications of a vehicle – such as lane departure assistance, advanced collision warning and factory-installed anti-theft devices – are programmed into your car’s Vehicle Identification Number (VIN). Your insurance provider uses the information programmed into your VIN when calculating your premiums, meaning that the safety specifications of your vehicle will already be taken into consideration.

Some insurance carriers will offer a discount for select vehicle safety features, such as an autonomous emergency braking system or an after-market ignition cut-off system. Your insurance broker will be able to provide more specific information about these discounts and can discuss your eligibility.

The future of technology and how it could impact my auto insurance

As technology continues to advance, the impact that car safety features have on your insurance premiums could begin to advance too. For example, the cost to install and repair car safety technologies could decrease over time, or the continuous advancements in safety tech could reduce accidents more significantly. For now, insurers still need more data on the effectiveness of these technologies before drivers will start to see a dramatic difference in their premiums.

Though today’s vehicle owners are not likely to see a breakdown of various discounts associated with each of their vehicle’s safety features on their insurance policies, it’s important to think of the other ways in which it pays to be a safer driver. Many insurance providers will offer discounts for drivers who have had no traffic violations in the last three years.

Similarly, drivers who have been licensed for over 15 years and are claims-free are also likely to be eligible for a discount on their car insurance premiums. If advanced vehicle safety technology helps you to be a safer driver, it could pay off in the long run.

If you have any questions about your car insurance policy or are currently shopping for car insurance, contact an OTIP insurance broker at 1-800-267-6847 to discuss your coverage options.